VAT & CCL Charges for Private Schools: The Latest Updates

What is VAT?

VAT or Value Added Tax is paid on most goods and services at a standard rate of 20%. Before Labour's new legislation, Private (or independent) schools were eligible for VAT exemption.

New VAT rules for private schools

Initially, all schools classed as education providers under the Education Act were exempt from VAT. However, Labour leaders recently confirmed that from 1 January, private (independent) schools will have to pay the full 20% tax rate. This also applies to any pre-paid fees from 29 July 2024 that cover costs after 1 January 2025.

Why has this been introduced?

According to the treasury, the new tax policy is expected to raise 1.725 billion annually. The Labour government says this money will be invested in improving education in state schools and hiring around 6,500 new teachers.

Will this cause school fees to rise by 20%?

Private schools are not expected to raise their fees by 20%. They don't have to reflect the VAT charge on the amount fee payers are charged. However, fees are predicted to increase by around 10%.

What will be liable for VAT?

Although private schools will now be charged 20% VAT on school fees and boarding services, it will not be a blanket charge covering every aspect of private school costs. The draft legislation specifically states that "other closely related" goods and services other than boarding (i.e. goods and services that are provided by a private school for the direct use of their pupils and that are necessary for delivering the education to their pupils) will remain exempt from VAT."

Currently, costs that could be classified as 'closely related' will not be subjected to tax.

This includes:

- School meals

- Transport

- Examination fees

- Books and stationery

- Wrap-around care, such as breakfast / non-educational holiday clubs

It should be noted that although breakfast clubs and holiday clubs are not affected by the new 20% tax for private schools policy, educational after-school clubs and holiday clubs, such as fees for extra tutoring, will be.

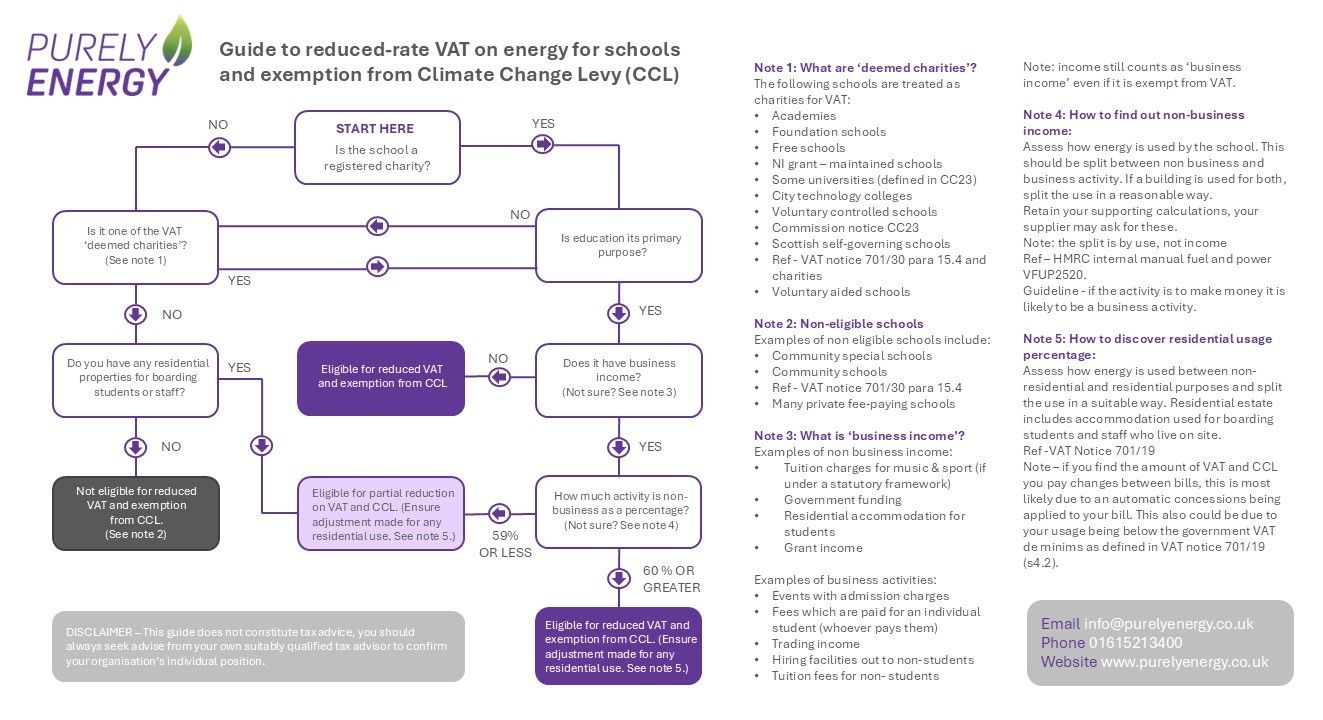

Is your school eligible for relief of VAT & CCL?

If your private / independent school is classed as a charity, which approximately 50% of independent schools are, you may be entitled to relief from a number of taxes. Charities and non-profit organisations are entitled to a 20% down to 5% VAT reduction on energy used for 'non-business purposes', in addition to being exempt from Climate Change Levy charges (CCL). A recent study showed that over a third of charities (37%) were unaware that they could claim a reduced rate of VAT and CCL exemption.

Assisting you one step further..

Once your energy charges are amended, your school will be able to reap the rewards of a lower energy bill each month, but keeping track of your energy usage could be another great way to keep costs low. Whether your school is made up of one or more buildings and departments, tracking energy usage across the site can be tricky and it's difficult to target problem areas of unnecessarily high energy usage.

Purely Energy is offering free energy software management for all customers - INSIGHT. Your account manager will work closely with you to develop long-term energy saving strategies. Purely Energy will help deliver bespoke services that generate long-term savings, ensuring your school has the financial security and educational excellence it deserves.

If you have any queries about how the latest updates on VAT for private schools or would like help lowering your energy costs, contact us at 0161 521 3400 or Info@purelyenergy.co.uk. Alternatively, Get a Quick Quote.

This article was written by Megan Glover and Harvey Rowlinson of Purely Energy. If there are any suggestions or questions - Please get in touch with us. *This document is not tax advice, please consult with your school bursar for further information.